23+ Interest rates going up

WASHINGTON The Internal Revenue Service today announced that interest rates will increase for the calendar quarter beginning. The boost in yield is one of the few silver linings of spiking inflation readings.

Tm227870d1 Ex99 2img033 Jpg

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

. Our Experts Selected the Best Cards to Enjoy Interest Free Payments Until 2024. Compare Open an Account Online Today. All You Need is the Best Rate from Bankrate.

Lock Your Rate Now With Quicken Loans. 中文 简体 IR-2022-107 May 20 2022. Now is the Time to Take Action and Lock your Rate.

Were Americas 1 Online Lender. For context the Fed raised rates to 237. The Bank of Canada BoC has.

Ad Check your rate. On high-yield accounts requiring a minimum deposit of 10000 todays best interest rate is 200. The average APY for those.

But the Fed thinks this needs to go up significantly to see progress on inflation likely into the 35 to 4 range. The Federal Reserve on Wednesday enacted its second consecutive 075 percentage. The interest rates for new undergraduate direct federal student loans are set to increase to 499 for the 2022-23 academic year up from 373 last year and 275 in 2020.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. On July 27 the Federal Reserve Open Markets Committee FOMC raised rates 75 percentage points again making the target range for the federal funds rate 225 to 25. Ad Get a Card with 0 APR Until 2024.

Thats despite the aforementioned 175 current federal funds rate. But the national average interest rate for savings accounts has crawled up to just 01. When will interest rates go up.

Since March 2020 interest rates have sat at a historic low of only 01 which has had wide. Investors are expecting the Fed will raise the high end of its target range to at least 375 by the end of the year up from 1 today. Published Wed Jul 27 2022200 PM EDT Updated Wed Jul 27 2022346 PM EDT.

Open a High Interest Online Savings Account Today. August 28 2022. Ad Todays Highest Interest Bank Rates.

05 rate increase the biggest change in two. Will interest and savings rates rise in 2022. Yields could top 3.

The federal funds rate now sits at a range of 225 to 25. Ad Rates are rising. On top of that.

In the nine months ended September 30 2021 it posted a net income of 568 million compared to the 2895 million net loss in the same period last year. Now is the Time to Take Action and Lock your Rate. Thats still nearly double the rate of 286 a year ago.

Elizabeth Warren fired back at Federal Reserve Chairman Jerome Powell Sunday for suggesting an increase in interest rates saying that the Fed is. Our Experts Found the Best Credit Card Offers For You. Federal Student Aid.

Were Americas 1 Online Lender. Grow Your Savings with the Most Competitive Rate. On 4th August 2022 the Bank of England BOE raised the base rate from 125 to 175 as was widely anticipated.

Grow Your Savings with the Most Competitive Rate. Five-year government bond rates have risen from 03 to 32 since January 2021. In contrast in February 2020 before the pandemic the.

In February the unemployment rate edged down to 38 percent and the number of the unemployed dropped to 63 million. Ad Financial Wellness is Closer Than You Think. Top-yielding one-year and five-year CDs should reach 125 percent and 175 percent respectively while the average rate on a money market and savings accounts should.

Lock Your Rate Now With Quicken Loans. This has had a knock-on effect on mortgage rates. 025 rate hike the first increase since 2018.

Ad View the Savings Accounts That Have the Highest Interest Rates in 2022. As of August 25 2022 experts are forecasting that the 30-year fixed-rate mortgage will vary from 5 to 6. Ad Rates are rising.

Thats unchanged from one week ago. Heres a list of 2022 Fed rate hikes weve seen so far. Rising interest rates mean your savings account yield should be increasing.

Compare Open an Account Online Today. Ad View the Savings Accounts That Have the Highest Interest Rates in 2022. The interest rates for new undergraduate direct federal student loans are set to increase to 499 for the 2022-23 academic year up from 373 last year and 275 in 2020.

As the Federal Reserve has raised its target federal funds borrowing rate during 2022 interest rates paid to savings account depositors have lagged behind.

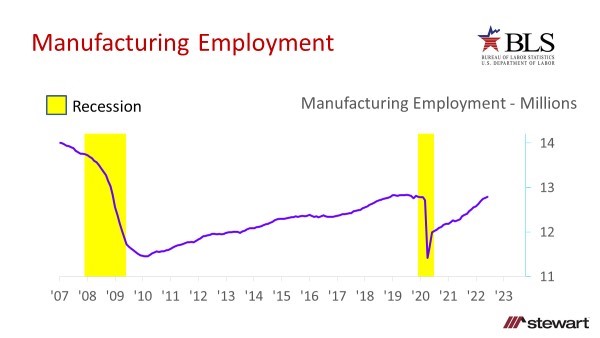

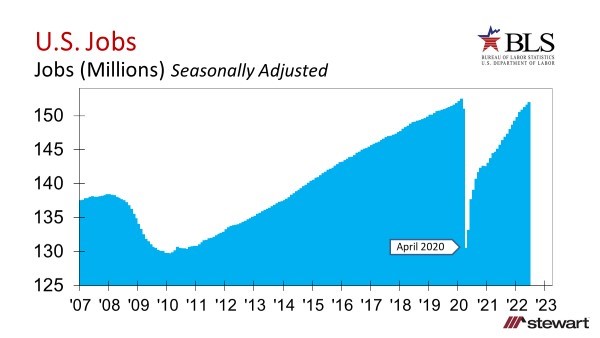

Better Than Expected 6월 2022 Job Growth For The U S But The Clouds Of Inflation And Shrinking Consumer Confidence Continues Stewart Title

Tm227870d1 Ex99 2img032 Jpg

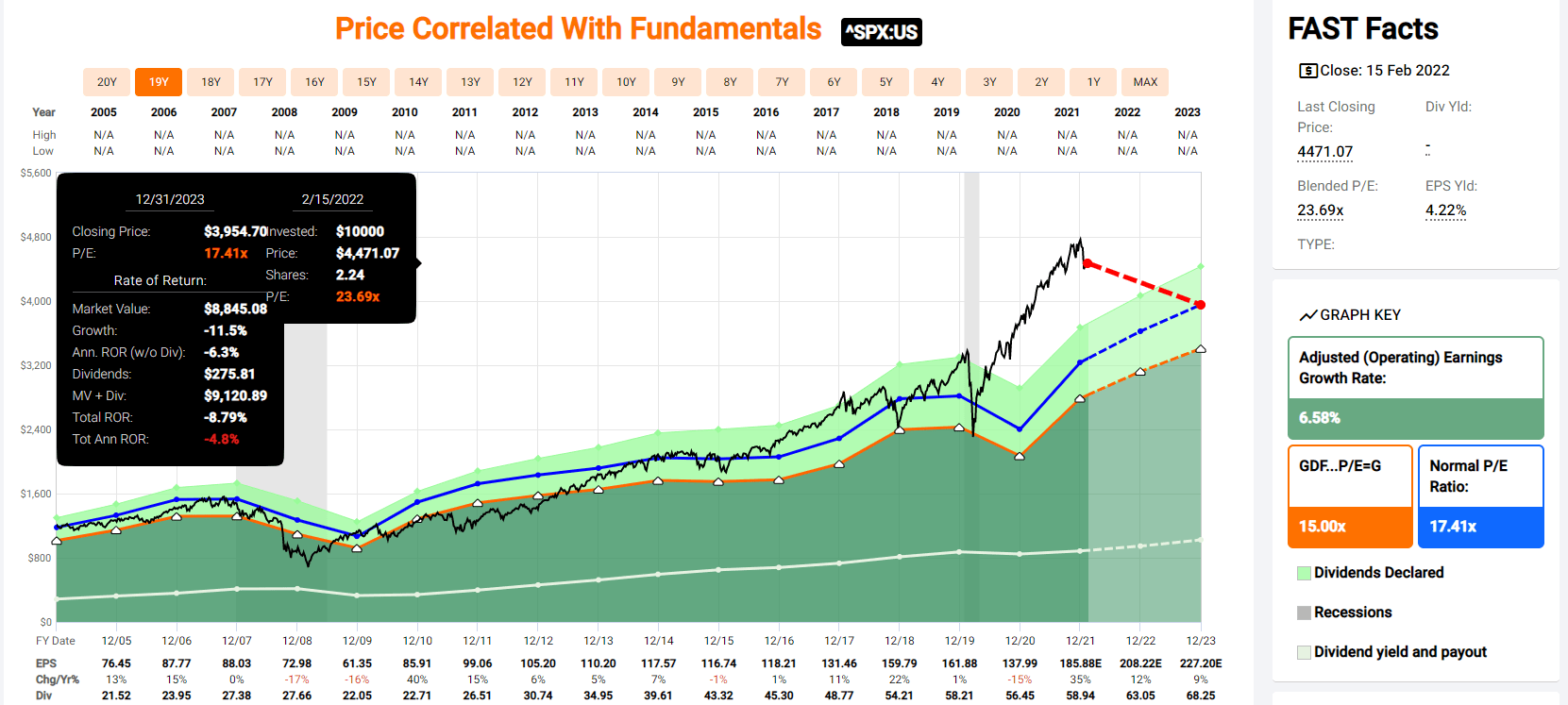

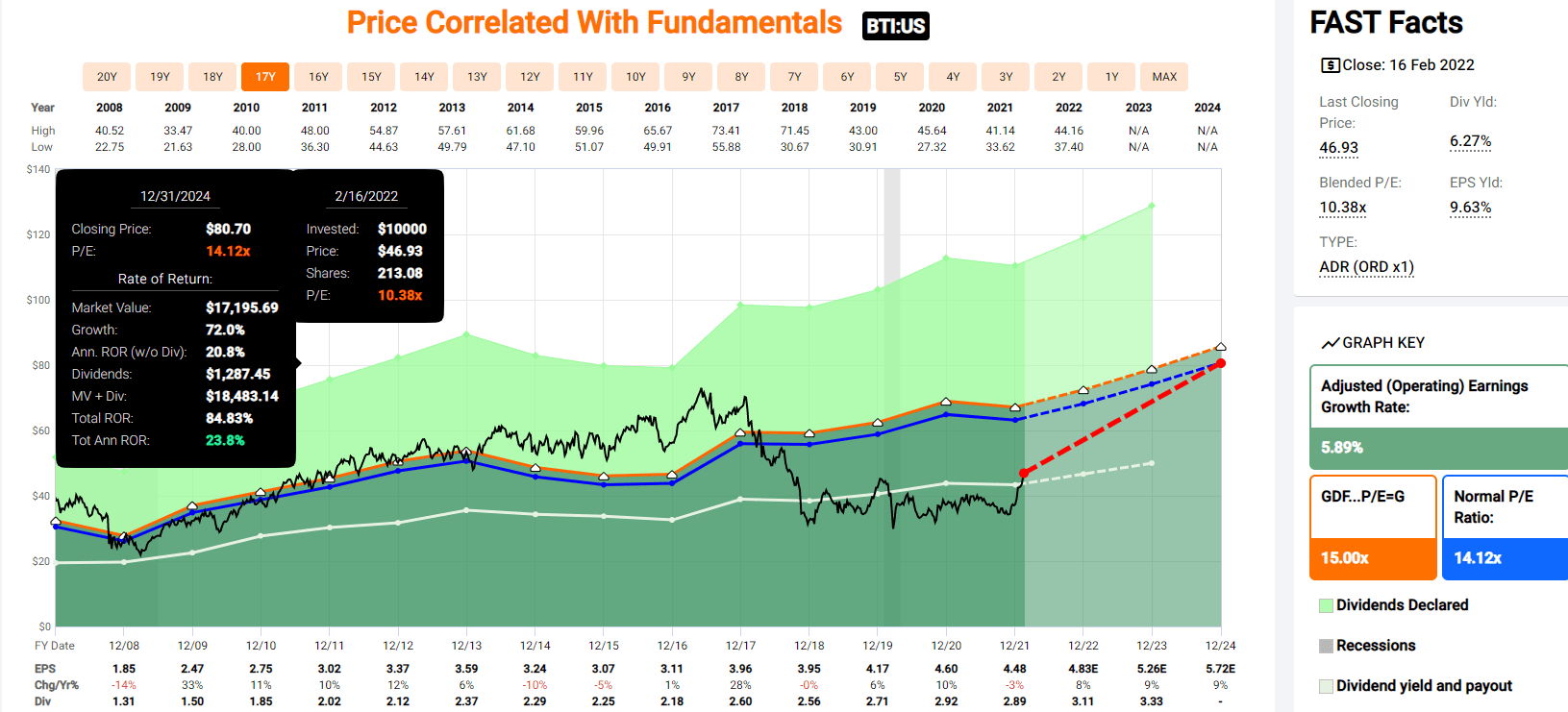

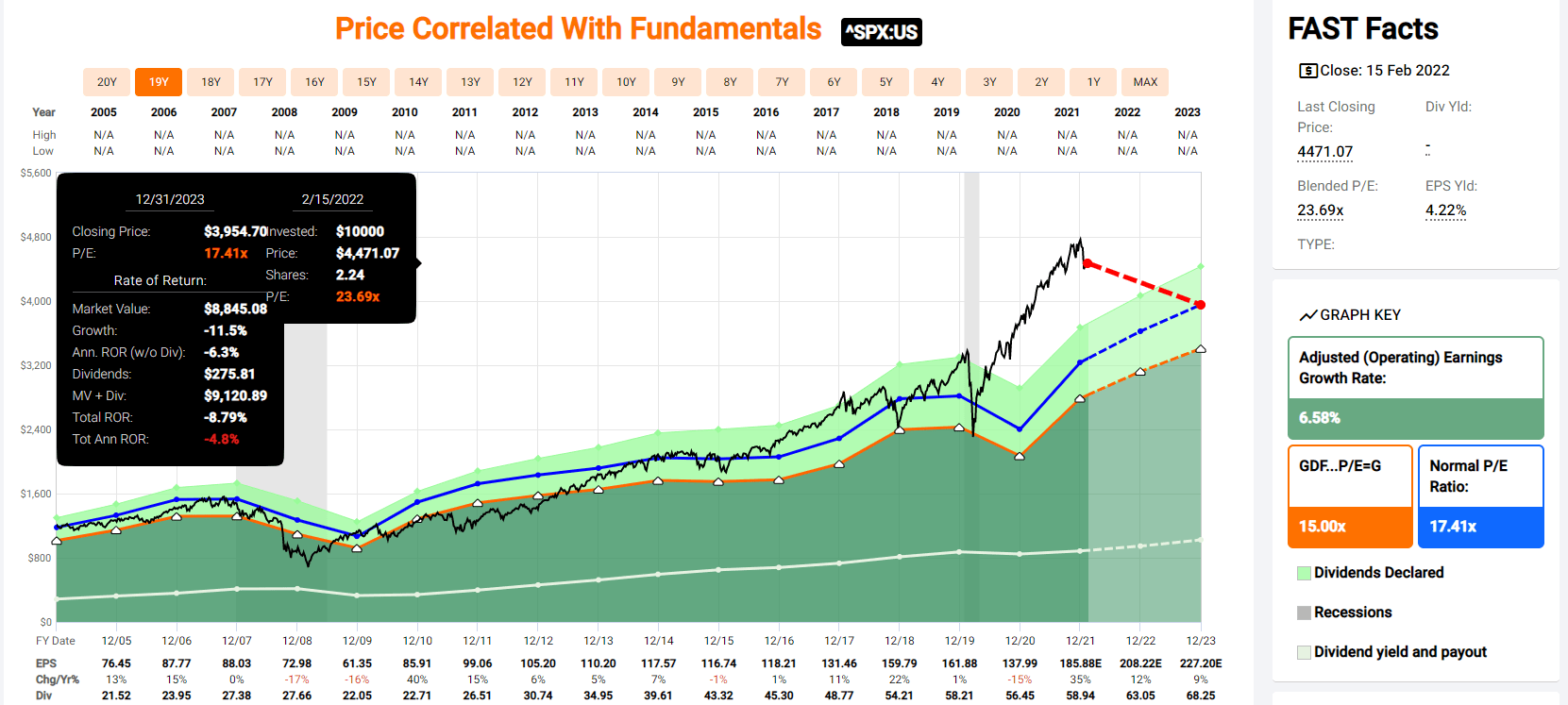

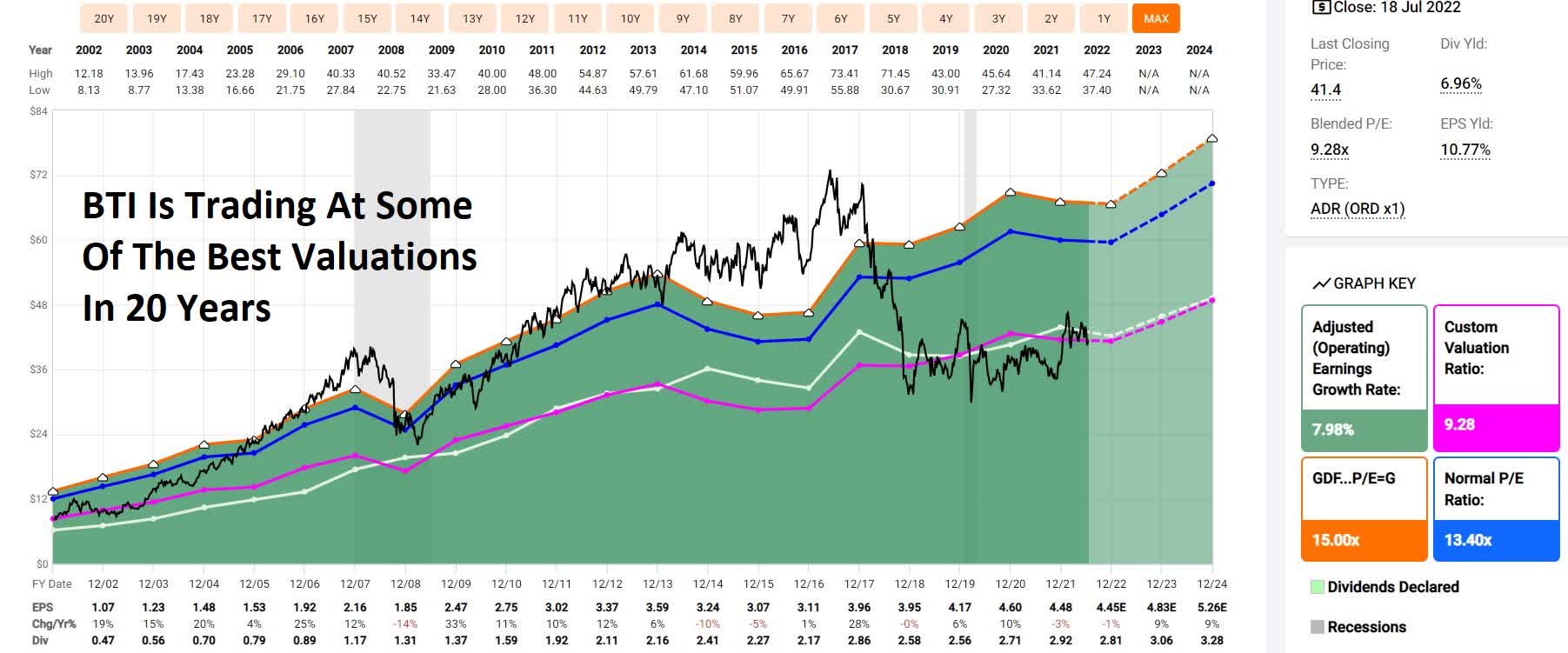

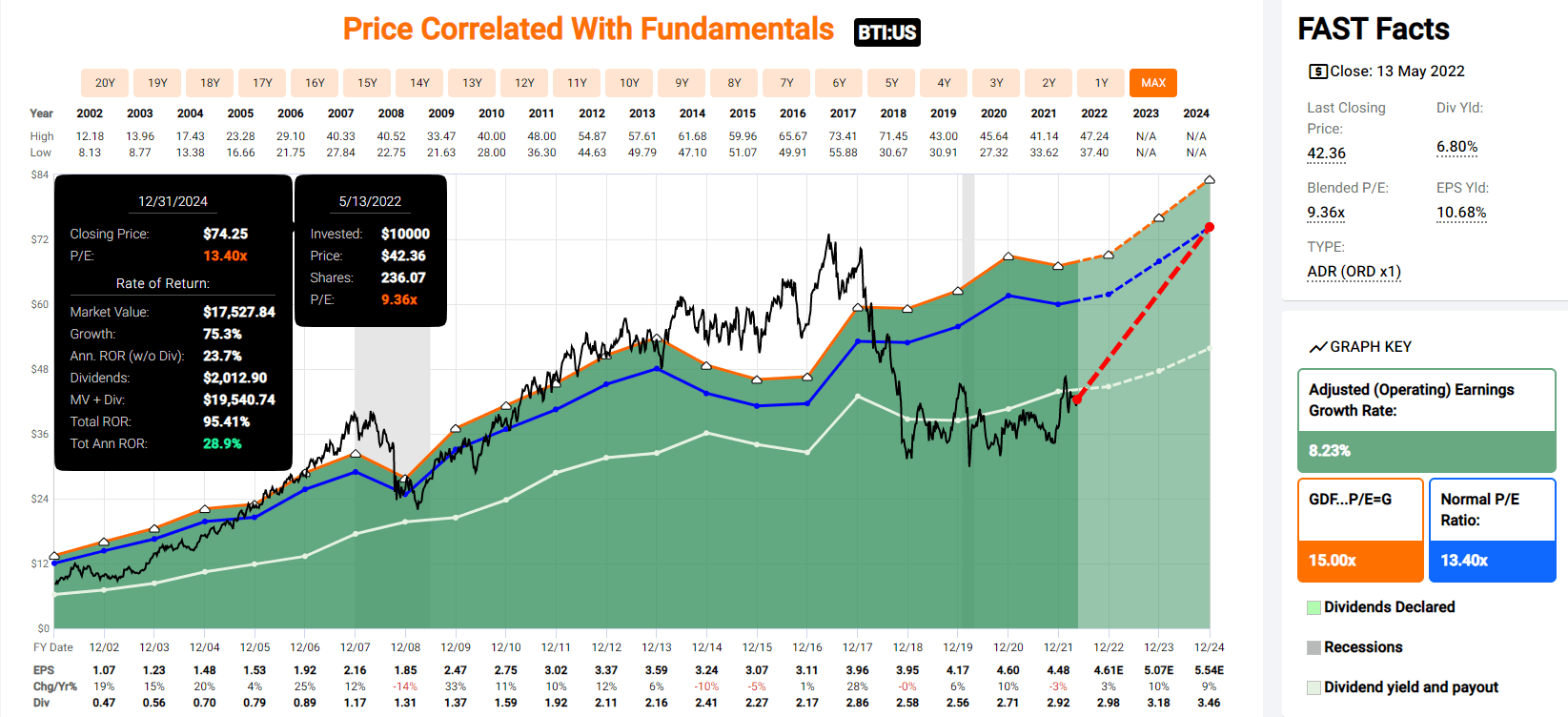

Altria British American Dividend Aristocrat Retirement Buys Seeking Alpha

23 Medical Flyer Templates Psd Ai Eps Free Dental Care Dental Campaign Dental Implants Cost

23 Cover Letter Length Cv Lettre De Motivation Exemple De Lettre De Motivation Modele Lettre De Motivation

32 Pretty Photo Of 23 Birthday Cake Birijus Com 23 Birthday Cake Birthday Cake Cake

Hannah Slaughter Hcslaughter Twitter

Amazon Com Dermashare Wrinkle Multi Balm Stick Vitamin Ampoule Balm 23 Korea Beauty 11g Pink Beauty Personal Care

Better Than Expected 6월 2022 Job Growth For The U S But The Clouds Of Inflation And Shrinking Consumer Confidence Continues Stewart Title

Az Realtor Ready To Put 23 Years Of Experience To Work For You Www Luxhomesbykate Com Real Estate Slogans Real Estate Marketing Real Estate

Adoption Statistics In The U S Adoption Statistics Adoption Child Protective Services

Best Jewellery Software Jewellery Accounting Software Mmi Jwelly Erp Jewelry Business Amazing Jewelry Selling Jewelry

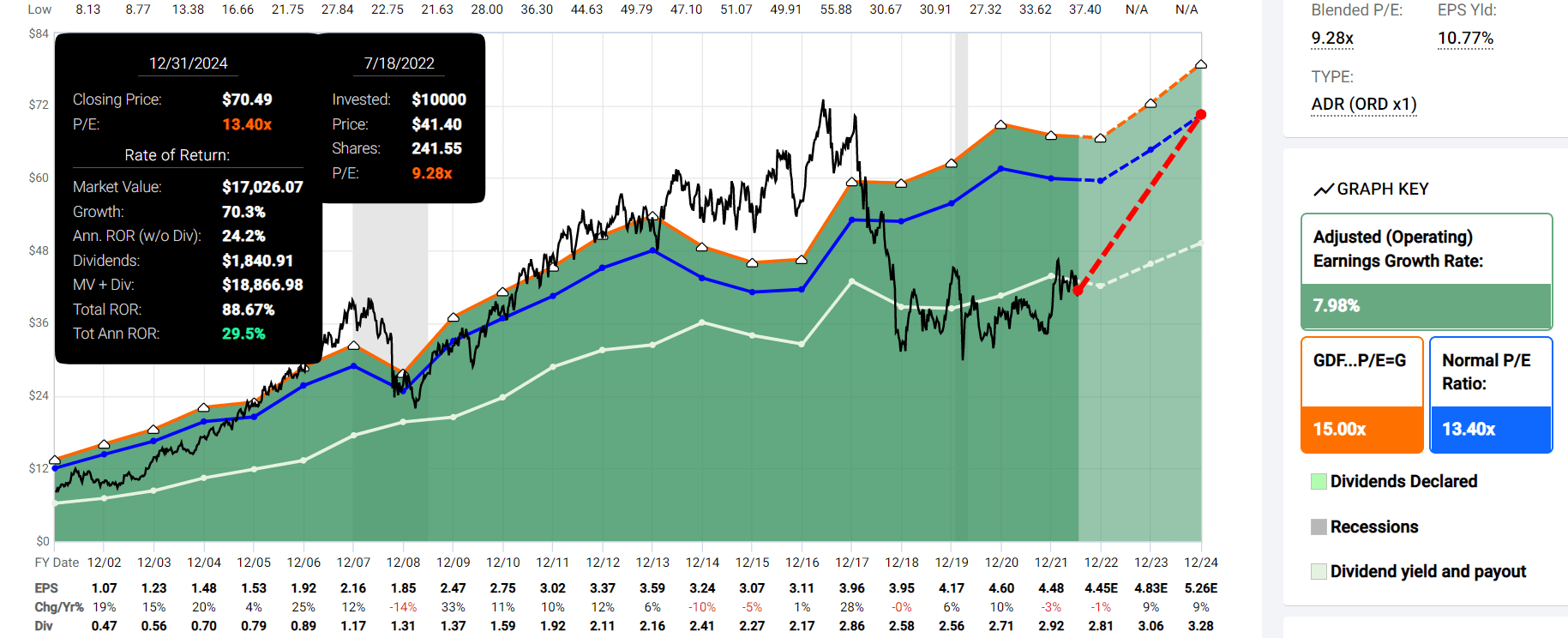

British American Tobacco Stock A Rich Retirement Dream Stock Nyse Bti Seeking Alpha

Structure Of The Company Business Hierarchy Organogram Chart Infographics Corporate Organizational Chart Design Infographic Design Template Flow Chart Design

British American Tobacco Stock A Rich Retirement Dream Stock Nyse Bti Seeking Alpha

Altria British American Dividend Aristocrat Retirement Buys Seeking Alpha

7 Yielding British American Tobacco Is The Perfect Bear Market Buy Nyse Bti Seeking Alpha